Decentralized finance (DeFi) A New Financial Frontier

Decentralized finance (DeFi) is revolutionizing the financial world by offering open, transparent, and permissionless financial services built on blockchain technology. Unlike traditional finance, which relies on centralized intermediaries like banks, DeFi leverages smart contracts and distributed ledger technology to automate and streamline various financial processes. This creates opportunities for greater efficiency, accessibility, and potentially lower costs for users worldwide.

This shift towards decentralization promises to democratize finance, empowering individuals and businesses with greater control over their assets and financial interactions. However, this innovative landscape also presents unique challenges, including security risks and regulatory uncertainties that need careful consideration. This exploration will delve into the core principles, applications, risks, and future potential of this transformative technology.

Defining Decentralized Finance (DeFi)

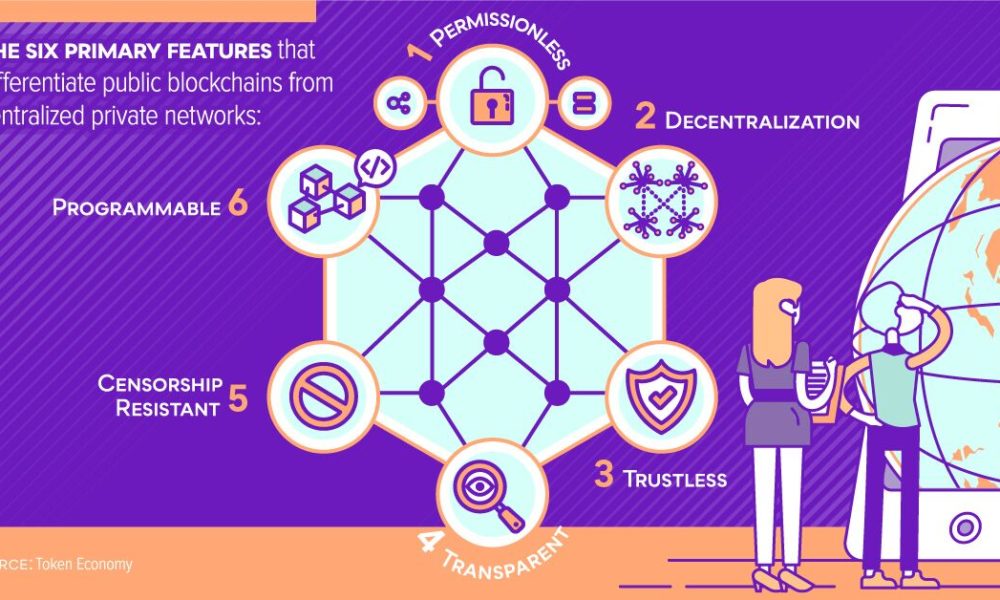

Decentralized Finance, or DeFi, represents a radical shift in how financial services are delivered. Unlike traditional finance, which relies on centralized intermediaries like banks and brokers, DeFi leverages blockchain technology to create a transparent, permissionless, and often more efficient financial ecosystem. This allows for greater financial inclusion and innovation.DeFi’s core principles revolve around decentralization, transparency, and programmability. Decentralization means no single entity controls the system, reducing the risk of censorship or single points of failure.

Transparency comes from the immutable nature of blockchain records, allowing anyone to audit transactions. Programmability, enabled by smart contracts, allows for the automated execution of financial agreements without the need for intermediaries. This contrasts sharply with traditional finance, which is characterized by centralized control, often opaque processes, and reliance on trusted third parties.

Key Technological Components of DeFi

Blockchain technology forms the foundation of DeFi. A blockchain is a distributed, immutable ledger that records all transactions across a network of computers. This shared, secure database ensures that transactions are verifiable and tamper-proof. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate the execution of financial agreements on the blockchain. These contracts operate according to pre-defined rules, removing the need for intermediaries to enforce agreements.

The combination of blockchain and smart contracts allows for the creation of trustless and transparent financial applications.

Examples of DeFi Applications

Several DeFi applications demonstrate the versatility of this technology. Decentralized exchanges (DEXs), such as Uniswap and SushiSwap, allow users to trade cryptocurrencies without relying on centralized exchanges. These platforms offer increased liquidity and reduced counterparty risk. Lending and borrowing protocols, such as Aave and Compound, enable users to lend or borrow cryptocurrencies, earning interest on deposits or accessing loans without needing a traditional bank.

Stablecoins, like Dai and USDC, aim to provide price stability in the volatile cryptocurrency market, pegged to fiat currencies or other assets. These are just a few examples, and the DeFi landscape is constantly evolving with new and innovative applications emerging.

DeFi Protocols and Applications

Decentralized finance (DeFi) wouldn’t exist without the protocols that power its applications. These protocols are essentially sets of rules and smart contracts that govern the lending, borrowing, trading, and other financial activities within the DeFi ecosystem. Understanding their features and security is crucial to navigating this rapidly evolving space. Different protocols offer unique functionalities, security implementations, and governance structures, leading to a diverse and competitive landscape.

Decentralized finance (DeFi) is revolutionizing financial services, offering transparency and accessibility. However, scalability remains a challenge; this is where the speed and low latency of Edge computing and 5G become crucial. By processing transactions closer to users, these technologies could significantly improve DeFi’s performance and user experience, paving the way for wider adoption.

The security and functionality of DeFi protocols are paramount. Security breaches can have devastating consequences, impacting users’ funds and the overall trust in the DeFi ecosystem. Features like transparency, auditability, and robust security measures are critical aspects that differentiate protocols and influence user adoption.

Comparison of DeFi Protocols

The following table compares several prominent DeFi protocols, highlighting their key features, security models, governance tokens, and Total Value Locked (TVL). TVL serves as a metric indicating the amount of cryptocurrency locked within the protocol, often reflecting its popularity and liquidity. Note that TVL is a dynamic figure and fluctuates constantly.

| Protocol Name | Key Features | Security Model | Token | Approximate TVL (USD – This is an example and fluctuates greatly) |

|---|---|---|---|---|

| Aave | Lending and borrowing, flash loans, liquidity mining | Multi-signature wallets, security audits, bug bounty programs | AAVE | $1,000,000,000 (Example) |

| Compound | Algorithmic lending and borrowing, interest rate markets | Formal verification, security audits, community monitoring | COMP | $500,000,000 (Example) |

| Uniswap | Decentralized exchange (DEX), automated market maker (AMM) | Smart contract security audits, decentralized governance | UNI | $2,000,000,000 (Example) |

| MakerDAO | Stablecoin issuance (DAI), collateralized debt positions (CDPs) | Multi-collateral DAI, risk parameters, governance voting | MKR | $800,000,000 (Example) |

| Curve Finance | Stablecoin exchange, AMM optimized for low slippage | Formal verification, security audits, community monitoring | CRV | $1,500,000,000 (Example) |

The Role of Stablecoins in DeFi Ecosystems

Stablecoins play a vital role in DeFi, acting as a bridge between the volatile cryptocurrency market and the more stable fiat currency world. They are designed to maintain a relatively stable value, typically pegged to a fiat currency like the US dollar. This stability is crucial for various DeFi applications, mitigating the risks associated with volatile cryptocurrency prices. For instance, stablecoins are frequently used in lending and borrowing protocols to reduce the impact of price fluctuations on users’ assets.

The most prominent examples include Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). The use of stablecoins enables more predictable and efficient financial transactions within the DeFi ecosystem, facilitating greater participation and reducing uncertainty.

Risks and Challenges in Decentralized Finance

Decentralized finance (DeFi) offers exciting possibilities, but it’s crucial to acknowledge the inherent risks and challenges that come with this innovative technology. While promising greater financial inclusion and efficiency, the decentralized nature of DeFi also introduces vulnerabilities and uncertainties that require careful consideration. This section will explore some key security risks, the evolving regulatory landscape, and the potential consequences of significant DeFi exploits.

Security Vulnerabilities and Risks in DeFi Platforms

Smart contracts, the backbone of many DeFi platforms, are susceptible to various vulnerabilities. Bugs in the code can be exploited by malicious actors, leading to significant financial losses. These vulnerabilities can range from simple coding errors to more sophisticated attacks that target specific weaknesses in the platform’s design. Furthermore, the reliance on external oracles (data providers) introduces another point of failure.

If an oracle is compromised or provides inaccurate data, it can lead to cascading failures within the DeFi ecosystem. Finally, the lack of centralized oversight means that there’s no single entity responsible for resolving issues or compensating victims of exploits. This lack of a central authority is both a strength and a weakness of the DeFi model.

Regulatory Landscape and Implications for DeFi Growth

The regulatory landscape surrounding DeFi is still largely undefined. Governments worldwide are grappling with how to regulate this rapidly evolving space, balancing the potential benefits of DeFi with the need to protect consumers and maintain financial stability. Some jurisdictions are adopting a wait-and-see approach, while others are actively exploring regulatory frameworks. The lack of clear regulatory guidelines creates uncertainty for developers, investors, and users alike.

This uncertainty can hinder the growth of the DeFi ecosystem, as businesses may be hesitant to invest in projects with unclear legal standing. The potential for regulatory scrutiny also poses a significant risk to DeFi projects that operate in a manner deemed illegal or unsafe by authorities. Ultimately, the future growth of DeFi will significantly depend on the development of clear and consistent regulatory frameworks.

Hypothetical DeFi Exploit Scenario and Consequences

Imagine a scenario where a DeFi lending platform, built on a popular blockchain, suffers a critical vulnerability in its smart contract. A malicious actor discovers a flaw that allows them to borrow vast sums of cryptocurrency without providing adequate collateral. This exploit could involve manipulating the platform’s algorithms to artificially inflate the value of the collateral they provide, or perhaps exploiting a reentrancy vulnerability to drain funds repeatedly.

The attacker could then use these borrowed funds to manipulate markets, potentially causing significant price swings and losses for other users. The platform itself might become insolvent, leading to the loss of funds for lenders and borrowers alike. Beyond the direct financial losses, the exploit could severely damage the reputation of the platform and the broader DeFi ecosystem, eroding trust and hindering future growth.

This hypothetical scenario highlights the potential for catastrophic consequences stemming from security vulnerabilities in DeFi platforms, emphasizing the need for rigorous security audits and robust risk management practices.

The Future of DeFi

Decentralized finance (DeFi) is still in its nascent stages, but its potential to revolutionize the global financial system is undeniable. The coming years will likely witness significant advancements, shaping DeFi into a more robust, accessible, and integrated part of the financial landscape. This section explores key areas of anticipated development and their potential impact.

Scalability Solutions

Current DeFi protocols often face limitations in terms of transaction speed and throughput. High gas fees and network congestion are significant hurdles to wider adoption. Future developments will focus heavily on improving scalability. Solutions such as layer-2 scaling solutions (like Optimism and Arbitrum), sharding (dividing the blockchain into smaller, more manageable parts), and the development of more efficient consensus mechanisms (like proof-of-stake variations) are crucial for addressing these limitations.

For example, the success of layer-2 solutions on Ethereum has already shown a significant reduction in transaction costs and increased speed for users. This trend will likely continue, leading to a more user-friendly DeFi experience.

Regulatory Frameworks, Decentralized finance (DeFi)

The regulatory landscape surrounding DeFi remains largely undefined. Governments worldwide are grappling with how to regulate decentralized, borderless financial systems. The future of DeFi will depend significantly on the development of clear and consistent regulatory frameworks. These frameworks will need to balance the need for consumer protection and preventing illicit activities with the preservation of DeFi’s core principles of decentralization and innovation.

A likely scenario involves a mix of self-regulation within the DeFi community, alongside collaboration with regulatory bodies to establish guidelines and standards. Examples include the establishment of working groups involving regulatory bodies and DeFi projects to explore compliance solutions.

Cross-Chain Interoperability

Currently, many DeFi protocols operate on isolated blockchains. This limits the potential for interoperability and the seamless transfer of assets and value between different ecosystems. The future of DeFi will likely involve increased cross-chain interoperability, enabling users to access a wider range of services and assets across different platforms. Technologies like bridges and interoperability protocols will play a critical role in facilitating this.

For instance, the growth of Cosmos and Polkadot, which aim to create interconnected blockchain ecosystems, highlights the growing importance of cross-chain communication. This would allow users to easily move assets between Ethereum, Solana, and other blockchains, opening up new possibilities for DeFi applications.

DeFi and the Metaverse

The convergence of DeFi and the metaverse presents exciting possibilities. Imagine a metaverse where users can seamlessly manage their digital assets, participate in decentralized lending and borrowing platforms, and engage in other DeFi activities within immersive virtual environments. This integration could create new opportunities for decentralized gaming, virtual land ownership, and other applications. For example, decentralized autonomous organizations (DAOs) could manage virtual worlds and economies, using DeFi protocols to distribute rewards and govern community resources.

This integration would require robust security measures and user-friendly interfaces tailored to the metaverse experience.

DeFi and Web3

DeFi is intrinsically linked to Web3, the decentralized internet. As Web3 matures, we can expect to see a deeper integration between DeFi and other Web3 technologies, such as decentralized identity (DID) and decentralized storage. DID could enhance user privacy and security in DeFi applications, while decentralized storage solutions could provide more robust and resilient infrastructure for DeFi protocols.

This symbiotic relationship will drive further innovation and adoption of both DeFi and Web3 technologies. For example, the use of DID to prove identity and creditworthiness could revolutionize decentralized lending and borrowing.

DeFi Use Cases and Real-World Applications: Decentralized Finance (DeFi)

Decentralized finance (DeFi) is rapidly evolving, offering innovative solutions to traditional financial problems. Its core principle – removing intermediaries and leveraging blockchain technology – unlocks new possibilities across various financial sectors. This section explores several real-world applications of DeFi, highlighting its potential to revolutionize access to financial services.DeFi’s impact extends beyond simply replicating traditional finance; it creates entirely new avenues for financial interaction.

By cutting out central authorities, DeFi protocols can offer faster, cheaper, and more transparent services, particularly benefiting underserved populations globally. The increased accessibility and efficiency of DeFi are reshaping how individuals and businesses manage their finances.

Decentralized Lending and Borrowing

DeFi platforms like Aave and Compound allow users to lend and borrow cryptocurrencies without intermediaries. Users can deposit their assets into lending pools, earning interest, while others can borrow funds using these assets as collateral. This peer-to-peer lending model eliminates the need for banks or other financial institutions, offering greater flexibility and potentially higher returns for lenders and lower borrowing costs for borrowers.

For example, a user could lend their Bitcoin to earn interest, while another user could borrow Ethereum using their Bitcoin as collateral, all facilitated through smart contracts on a blockchain. This process is transparent and auditable, eliminating the opaque processes often associated with traditional lending.

Decentralized Trading

Decentralized exchanges (DEXs), such as Uniswap and SushiSwap, enable users to trade cryptocurrencies without relying on centralized exchanges. These platforms use automated market makers (AMMs) – algorithms that determine prices based on supply and demand – to facilitate trades. This eliminates the risks associated with centralized exchanges, such as hacking and censorship, offering users greater control and security over their assets.

For instance, a trader could swap Ether for a smaller-cap altcoin without needing to trust a centralized exchange with their funds. The decentralized nature ensures transparency and prevents manipulation by a single entity.

DeFi’s Impact on Financial Inclusion

DeFi has the potential to significantly improve financial inclusion by providing access to financial services for underserved populations. Millions of people globally lack access to traditional banking systems, often due to geographical limitations, stringent requirements, or high fees. DeFi platforms can bypass these barriers, offering access to lending, borrowing, and investment opportunities regardless of location or credit history.

Microloans, for instance, can be easily distributed through DeFi protocols, empowering entrepreneurs in developing countries with access to capital. Furthermore, international remittances, often burdened by high fees and slow processing times through traditional channels, can be significantly improved using DeFi, resulting in faster and cheaper transactions.

International Remittances and Microloans using DeFi: Benefits and Limitations

The potential benefits and limitations of using DeFi for specific financial activities need careful consideration.

- International Remittances:

- Benefits: Lower fees, faster transaction speeds, increased transparency, reduced reliance on intermediaries.

- Limitations: Volatility of cryptocurrencies, regulatory uncertainty, technical complexity for some users, potential for scams.

- Microloans:

- Benefits: Increased access to capital for underserved populations, lower interest rates compared to traditional microfinance, faster disbursement of funds.

- Limitations: Requires users to have access to internet and cryptocurrency wallets, potential for defaults, volatility of cryptocurrencies can impact loan repayment.

DeFi Governance and Community

Source: visualcapitalist.com

DeFi’s decentralized nature presents a unique challenge: how to govern these systems fairly and effectively without centralized authorities. Different projects employ diverse governance models, each with its strengths and weaknesses, significantly impacting the project’s long-term success and community engagement. The role of the community is paramount, as their active participation shapes the future direction and resilience of these platforms.Different DeFi projects utilize various governance models, each impacting decision-making processes and community participation.

The effectiveness of these models hinges on factors such as transparency, participation rates, and the mechanisms for resolving disputes.

Governance Models in DeFi

DeFi governance models vary considerably. Some projects use a token-weighted voting system, where token holders have voting power proportional to their holdings. This model can incentivize participation but may lead to concerns about whale dominance – where a small number of large token holders can disproportionately influence decisions. Other projects employ quadratic voting, aiming to mitigate the influence of large holders by giving more weight to smaller token holders.

Decentralized finance (DeFi) is revolutionizing the financial world, offering new possibilities for transactions and investments. The speed and low latency of widespread 5G connectivity, like that discussed in this article on 5G network expansion , will be crucial for DeFi’s growth. Faster transaction speeds and improved accessibility are key to DeFi’s wider adoption and ultimately, its success.

Some projects also incorporate multi-signature wallets, requiring multiple approvals for significant decisions, adding a layer of security and preventing hasty actions. Finally, some DeFi protocols employ a hybrid model, combining aspects of different approaches to address specific needs and challenges. For example, MakerDAO, a prominent DeFi project, utilizes a complex governance system combining token voting with a more complex structure of committees and executive decision-making.

The Role of Decentralized Autonomous Organizations (DAOs) in DeFi Governance

DAOs play a central role in DeFi governance. They act as decentralized entities, governed by rules encoded on a blockchain, automating decision-making processes. DAOs often use token-based voting to allow token holders to participate in proposals, discussions, and votes on various aspects of the protocol’s development and operation. The transparency inherent in blockchain technology ensures that all governance activities are publicly auditable.

This fosters trust and accountability within the community. However, DAOs also face challenges, such as vulnerability to attacks, difficulty in reaching consensus, and the potential for slow decision-making processes. The effectiveness of a DAO relies heavily on the design of its governance structure and the active engagement of its community members.

Community Involvement in DeFi Projects

Community involvement is crucial for the success of any DeFi project. An active and engaged community can identify and report bugs, propose improvements, and help promote the project. This collaborative approach is essential for fostering innovation and building trust within the DeFi ecosystem. Community members often act as ambassadors, spreading awareness and attracting new users. Furthermore, active community participation helps to ensure the long-term sustainability and resilience of DeFi projects by identifying potential risks and vulnerabilities early on.

Projects that successfully cultivate strong community engagement tend to exhibit higher levels of user retention and overall project success. Conversely, a lack of community engagement can lead to stagnation, security vulnerabilities, and ultimately, the failure of the project. Effective communication channels, such as forums, social media groups, and dedicated governance platforms, are essential for facilitating this crucial interaction.

Illustrative Example: A DeFi Lending Platform

This section details a hypothetical decentralized lending platform, outlining its architecture, user flow, and risk management strategies. We’ll explore how smart contracts facilitate lending and borrowing without intermediaries, focusing on the key mechanisms that ensure security and transparency.This hypothetical platform, “LendDEX,” operates on a blockchain, leveraging smart contracts to automate loan origination, interest accrual, and repayment. Users interact with the platform through a user-friendly interface, while the underlying logic is governed by immutable code.

Platform Architecture

LendDEX employs a modular architecture. The core components include a smart contract system managing loan creation, interest calculations, and collateralization; an oracle system providing real-time price feeds for collateral assets; a user interface for interacting with the platform; and a governance module allowing for community-driven decision-making regarding platform parameters. The smart contracts are audited by independent security firms to minimize vulnerabilities.

Decentralized finance (DeFi) offers exciting possibilities, but its rapid growth raises questions about security and regulation. Thinking about the potential for misuse, it’s worth considering the ethical dilemmas raised by powerful technologies, like those discussed in The ethical implications of using quantum AI in autonomous weapons systems. Ultimately, responsible development is crucial for both DeFi and advanced AI, ensuring these powerful tools benefit humanity.

The oracle system integrates with multiple reputable sources to ensure data accuracy and prevent manipulation.

User Flow on LendDEX

The user experience on LendDEX is designed for simplicity and security. The process begins with account creation, which involves connecting a compatible crypto wallet. Next, users can either deposit collateral to become lenders or borrow funds by providing collateral. Let’s imagine a user, Alice, wants to borrow 1 ETH. The steps are as follows:

1. Account Creation

Alice connects her MetaMask wallet to LendDEX.

2. Collateral Deposit

Alice deposits 2 ETH as collateral (over-collateralization to mitigate risk). This collateral is locked in a smart contract.

3. Loan Request

Alice requests a 1 ETH loan.

4. Loan Approval (Automated)

The smart contract automatically approves the loan based on pre-defined risk parameters (e.g., collateralization ratio).

5. Loan Disbursement

1 ETH is transferred from the lending pool to Alice’s wallet.

Decentralized finance (DeFi) is revolutionizing the financial world, offering new possibilities for transparency and accessibility. However, the computational power needed to secure and scale these systems is immense. Understanding the limitations of current technology is crucial, which is why exploring the potential of quantum computing is important, as explained in this article about Understanding the quantum supremacy debate in the context of AI.

Ultimately, advancements in quantum computing could significantly impact the future of DeFi, potentially offering even greater security and efficiency.

6. Interest Accrual

Interest accrues daily, automatically calculated and added to the outstanding loan amount by the smart contract.

7. Loan Repayment

Alice repays the loan plus interest.

8. Collateral Release

Upon full repayment, the smart contract automatically releases Alice’s 2 ETH collateral back to her wallet.

Risk Management Strategies

LendDEX employs several risk mitigation strategies to protect both lenders and borrowers. These include:* Over-collateralization: Borrowers must deposit more collateral than the loan amount, ensuring lenders are protected even if the value of the collateral drops. The platform maintains a minimum collateralization ratio (e.g., 150%), dynamically adjusting this ratio based on market volatility.

Liquidation

If the value of a borrower’s collateral falls below the minimum collateralization ratio, the smart contract automatically liquidates the collateral to repay the loan. This liquidation process is transparent and governed by the smart contract. The liquidation process is designed to minimize losses for lenders.

Oracle Security

The platform uses multiple, independent oracles to obtain price feeds for collateral assets, reducing the risk of manipulation or inaccurate pricing. These oracles are rigorously vetted and regularly audited.

Smart Contract Audits

The smart contracts governing LendDEX are regularly audited by independent security firms to identify and fix potential vulnerabilities. The results of these audits are publicly available to enhance transparency.

Insurance Funds

A portion of the platform’s fees is allocated to an insurance fund to cover unexpected losses due to unforeseen circumstances, such as oracle failures or smart contract exploits (though extremely unlikely due to rigorous audits and multi-oracle usage).

Outcome Summary

Decentralized finance (DeFi) represents a paradigm shift in the financial landscape, offering exciting possibilities while also posing significant challenges. While security concerns and regulatory hurdles remain, the potential for increased financial inclusion, efficiency, and innovation is undeniable. As the technology matures and regulatory frameworks evolve, DeFi is poised to play an increasingly significant role in shaping the future of finance, potentially reshaping how we interact with money and financial services globally.

The journey is ongoing, but the potential impact is immense.

Essential Questionnaire

What are the main benefits of using DeFi?

Increased transparency, potentially lower fees, greater accessibility, and increased control over your assets are key benefits.

Is DeFi safe?

DeFi carries inherent risks due to smart contract vulnerabilities and the lack of traditional regulatory oversight. Thorough due diligence and understanding of the risks are crucial.

How do I get started with DeFi?

Start by researching different DeFi platforms and protocols. You’ll need a cryptocurrency wallet and some basic understanding of blockchain technology. Proceed cautiously and only invest what you can afford to lose.

What is a stablecoin and why is it important in DeFi?

A stablecoin is a cryptocurrency designed to maintain a stable value, usually pegged to a fiat currency like the US dollar. They are crucial in DeFi for mitigating volatility and facilitating smoother transactions.

What are the regulatory challenges facing DeFi?

The decentralized nature of DeFi makes regulation complex. Governments are grappling with how to balance innovation with consumer protection and preventing illicit activities.