Quantum AI Investment Opportunities and Risks

Investment opportunities and risks in the quantum AI industry are shaping the future of technology. This burgeoning field promises revolutionary advancements in artificial intelligence, driven by the immense computational power of quantum computers. However, alongside the potential for groundbreaking innovations and lucrative returns, significant technological, financial, and ethical challenges must be navigated. This exploration delves into the exciting possibilities and inherent risks of investing in this transformative sector, providing a balanced perspective on the opportunities and challenges ahead.

From understanding the current market size and key players to analyzing various investment avenues like startups and venture capital, we’ll examine the potential for high returns alongside the inherent volatility. We’ll also dissect the technological hurdles, including the limitations of current quantum algorithms and potential security vulnerabilities. A crucial aspect will be exploring the financial and market risks, comparing them to other emerging technologies and considering the impact of macroeconomic factors and regulations.

Finally, we’ll touch upon the ethical and societal implications of quantum AI, ensuring responsible development and deployment are central to the conversation.

Market Overview of Quantum AI

The intersection of quantum computing and artificial intelligence (Quantum AI) represents a nascent but rapidly evolving market poised for significant growth. While still in its early stages, the potential for Quantum AI to revolutionize various sectors is driving substantial investment and research efforts globally. This market overview explores the current landscape, key players, and technological advancements shaping this exciting field.

Estimating the precise current size of the Quantum AI market is challenging due to the technology’s immaturity and the lack of standardized metrics. However, reports suggest a market valued in the hundreds of millions of dollars, with projections indicating exponential growth in the coming years. Consultancy firms predict a market size reaching several billion dollars by the end of the next decade, driven by increasing investments in both quantum computing hardware and AI algorithms designed to leverage quantum capabilities.

This growth is fueled by the potential for Quantum AI to solve currently intractable problems in areas such as drug discovery, materials science, and financial modeling.

Key Players and Market Share

Several companies are at the forefront of the Quantum AI race, although market share data is not consistently reported across all players. IBM, Google, and Microsoft are major players, heavily investing in both quantum computing hardware and software development, including tools and platforms specifically designed for AI applications. Other significant contributors include Rigetti Computing, IonQ, and several startups focusing on specialized quantum computing architectures or algorithms.

These companies often collaborate with research institutions and universities, fostering innovation and accelerating technological progress. Precise market share figures are difficult to ascertain due to the evolving nature of the industry and the diverse approaches taken by different companies.

Technological Advancements Driving Market Growth

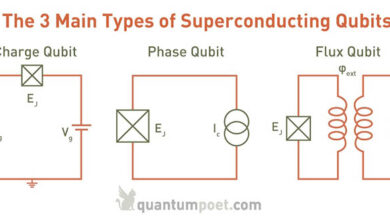

Several key technological advancements are fueling the rapid growth of the Quantum AI market. Improvements in qubit coherence times – the length of time a qubit maintains its quantum state – are crucial for performing complex computations. Advances in error correction techniques are essential for mitigating the inherent noise in quantum systems, improving the reliability of quantum computations.

The development of more efficient quantum algorithms specifically tailored for AI tasks, such as quantum machine learning algorithms, is another critical driver. Furthermore, the increasing availability of cloud-based quantum computing platforms allows researchers and developers to access quantum resources without significant upfront investments, accelerating innovation and collaboration.

Quantum Computing Platforms and Their Suitability for AI Applications

The following table compares different quantum computing platforms and their suitability for AI applications. It is important to note that the field is rapidly evolving, and the strengths and weaknesses of each platform can change as technology advances.

| Platform | Strengths | Weaknesses | Applications |

|---|---|---|---|

| Superconducting | High qubit counts, relatively mature technology | Susceptible to noise, requires cryogenic cooling | Quantum machine learning, optimization problems |

| Trapped Ion | High qubit coherence times, good scalability potential | Lower qubit counts compared to superconducting, more complex control systems | Quantum simulation, quantum chemistry |

| Photonic | Room-temperature operation, potential for scalability | Lower qubit coherence times compared to trapped ion, challenges in creating complex quantum gates | Quantum communication, quantum key distribution |

| Annealers | Specialized for optimization problems, relatively mature technology | Limited applicability beyond optimization, not a universal quantum computer | Logistics optimization, financial modeling |

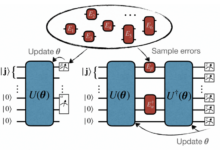

Investment Opportunities in Quantum AI

Source: ytimg.com

The quantum AI industry, while still nascent, presents a compelling array of investment opportunities for those willing to navigate the inherent risks. Several avenues exist, each with its own potential rewards and challenges. Understanding these avenues is crucial for making informed investment decisions in this rapidly evolving field.Investing in quantum AI isn’t just about technological advancement; it’s about positioning oneself at the forefront of a potential technological revolution.

The potential returns are significant, but so are the risks. Careful due diligence and a diversified approach are paramount.

Investing in quantum AI presents huge potential, but also significant risk. The technology’s rapid advancement creates exciting opportunities, particularly considering its transformative power. A key area to watch is how quantum AI will reshape cybersecurity, as detailed in this article on Quantum AI’s impact on cybersecurity and data encryption. Understanding this impact is crucial for assessing both the rewards and the dangers inherent in quantum AI investments.

This is especially true given the potential for both disruption and innovation within the sector.

Investment Avenues in the Quantum AI Sector

Several pathways exist for investors seeking exposure to the quantum AI sector. These include investments in early-stage startups, established publicly traded companies involved in quantum computing or AI, and venture capital funds specializing in this area. Each approach carries different levels of risk and potential reward. Startups offer high-growth potential but also higher risk, while established companies generally offer lower risk but potentially lower returns.

Venture capital provides diversified exposure but requires a longer-term investment horizon.

Examples of Successful Quantum AI Investments

While specific financial details of private investments are often confidential, several publicly available examples highlight the potential returns in this sector. For instance, some venture capital firms that invested early in companies developing quantum computing hardware have seen substantial returns as these companies have secured significant funding and partnerships. Publicly traded companies with a focus on quantum computing or AI-related technologies, while potentially less volatile than startups, can still yield significant returns for investors who identify promising companies early.

However, it’s important to remember that past performance is not indicative of future results.

Government Funding and Grants for Quantum AI Research and Development

Governments worldwide recognize the strategic importance of quantum AI and are actively investing in research and development through various grants and funding programs. These initiatives often support academic research, collaborations between academia and industry, and the development of national quantum computing infrastructure. For example, the US government, through agencies like the National Science Foundation (NSF) and the Department of Energy (DOE), has allocated significant funding to quantum information science.

Similarly, the European Union and several individual European nations have launched substantial funding programs for quantum technologies. While direct access to these grants is usually limited to research institutions and companies, indirect benefits can accrue to investors through the resulting technological advancements and increased industry activity.

Hypothetical Investment Portfolio for a Quantum AI-Focused Fund

A hypothetical diversified portfolio for a quantum AI-focused fund might allocate capital across different asset classes to mitigate risk and capitalize on various opportunities. A sample allocation could be:

- 30% allocated to publicly traded companies developing quantum computing hardware or software (e.g., companies involved in superconducting qubit technology, trapped ion technology, or quantum software development).

- 30% allocated to venture capital funds specializing in quantum AI startups (this provides exposure to a broader range of companies and technologies with high growth potential, but also higher risk).

- 20% allocated to companies developing quantum-enhanced AI algorithms and applications (e.g., companies focused on drug discovery, materials science, or financial modeling using quantum algorithms).

- 10% allocated to publicly traded companies whose businesses benefit from advancements in quantum computing or AI (e.g., cloud computing companies that might offer quantum computing services in the future).

- 10% allocated to bonds or other lower-risk assets to provide stability and reduce overall portfolio volatility.

This allocation represents a balanced approach, aiming to capture the potential high returns of early-stage investments while mitigating risk through diversification and inclusion of more stable assets. The specific companies and funds selected would require thorough due diligence based on factors such as technology maturity, management team, competitive landscape, and market potential. This is a hypothetical portfolio and should not be considered investment advice.

Technological Risks in Quantum AI

The promise of quantum AI is immense, but realizing that promise faces significant technological hurdles. Building and scaling quantum computers is incredibly complex, and the current capabilities of quantum algorithms are far from reaching their theoretical potential. Furthermore, the unique nature of quantum computing introduces novel security risks that must be addressed. These challenges, if not overcome, could significantly hinder the growth and adoption of quantum AI.The challenges associated with building and scaling quantum computers are substantial.

Current quantum computers are incredibly sensitive to environmental noise, requiring extremely low temperatures and highly controlled environments. This fragility makes them expensive and difficult to maintain, limiting their accessibility and scalability. Moreover, increasing the number of qubits, the fundamental units of quantum information, while maintaining coherence (the ability to maintain quantum superposition) is a major engineering feat.

The more qubits, the more complex the control systems and the greater the susceptibility to errors. This problem is often referred to as the “scaling problem” in quantum computing. Progress is being made, but significant breakthroughs are needed to build large-scale, fault-tolerant quantum computers.

Limitations of Current Quantum Algorithms, Investment opportunities and risks in the quantum AI industry

Current quantum algorithms, while showing promise in specific areas like optimization and simulation, are still limited in their applicability and efficiency. Many quantum algorithms are designed for specific problems and may not be easily adapted to other tasks. Furthermore, the development of efficient quantum algorithms is an active area of research, and many important problems remain unsolved in the quantum computing domain.

For instance, while quantum computers excel at simulating quantum systems, their application to classical machine learning tasks is not always straightforward or advantageous. The translation of classical AI algorithms into efficient quantum algorithms is often a complex and resource-intensive process. This limitation means that the immediate impact of quantum computing on AI applications is likely to be incremental rather than revolutionary, at least in the near term.

Security Risks and Vulnerabilities

The advent of quantum computing presents both opportunities and threats to cybersecurity. Quantum computers, once sufficiently powerful, could potentially break widely used encryption algorithms like RSA and ECC, which are the backbone of modern online security. This poses a significant risk to data privacy and security. Moreover, the development of quantum-resistant cryptography is crucial, but it is a complex and ongoing process.

Additionally, new vulnerabilities related to the control and operation of quantum computers themselves might emerge, creating potential avenues for malicious attacks. The development of robust quantum-resistant cryptographic protocols and the implementation of secure quantum computing architectures are critical to mitigating these risks.

Technological Hurdles Hindering Quantum AI Growth

The development of the quantum AI industry faces several significant technological hurdles:

- Qubit coherence and scalability: Maintaining the delicate quantum states of qubits for extended periods and scaling up the number of qubits while preserving coherence remains a major challenge.

- Error correction: Quantum computers are inherently prone to errors. Developing efficient and robust error correction techniques is essential for building fault-tolerant quantum computers.

- Algorithm development: Creating efficient quantum algorithms for a wide range of AI tasks is an active area of research, and progress is needed to unlock the full potential of quantum AI.

- Quantum hardware development: The development of more stable, scalable, and cost-effective quantum hardware is crucial for widespread adoption.

- Quantum-resistant cryptography: The development and implementation of quantum-resistant cryptographic protocols are essential to protect against future quantum attacks.

- Integration with classical systems: Seamless integration of quantum computers with classical computing infrastructure is necessary for practical applications.

Financial and Market Risks in Quantum AI

Investing in quantum AI presents a unique set of financial and market risks, distinct from those encountered in more established tech sectors. While the potential rewards are substantial, the nascent nature of the technology and the volatile market conditions create significant challenges for investors. Understanding these risks is crucial for making informed investment decisions.The risks associated with quantum AI investments are amplified by the technology’s early stage of development.

Unlike established technologies with proven track records and established markets, quantum AI faces considerable uncertainty regarding its future trajectory and market adoption. This uncertainty translates directly into higher investment risk compared to, for instance, established software companies or even other emerging technologies like advanced robotics, where at least some level of market validation and product commercialization exists. The potential for failure is higher, and the time horizon for realizing returns is significantly longer and less predictable.

Comparison of Risks with Other Emerging Technologies

Quantum AI investments carry higher risks than many other emerging technologies due to the fundamental scientific and engineering challenges involved. While other emerging tech sectors, such as artificial intelligence (AI) and biotechnology, have seen significant investment and some degree of commercial success, quantum computing remains largely in the research and development phase. The complexities of building and scaling quantum computers, coupled with the inherent uncertainties of quantum algorithms and their applications, create a risk profile that is significantly more volatile and less predictable than those seen in more mature technologies.

For example, a company developing AI-powered medical diagnostics might have a clearer path to revenue generation than a company developing quantum annealing algorithms for optimization problems. The latter faces greater uncertainties regarding both technological feasibility and market demand.

Market Volatility and its Impact on Quantum AI Investments

The quantum AI market is highly susceptible to volatility. Investor sentiment can shift dramatically based on technological breakthroughs, regulatory changes, or macroeconomic factors. A single negative news story or a setback in technological development can trigger a significant drop in the valuations of quantum AI companies. Conversely, a major scientific breakthrough or a successful product launch can lead to a surge in investment and valuations.

This volatility creates significant challenges for investors, requiring them to have a high risk tolerance and a long-term investment horizon. For example, the initial hype surrounding quantum computing in the early 2000s was followed by a period of disillusionment as technological hurdles proved more challenging than initially anticipated. This highlights the importance of carefully assessing the long-term potential of quantum AI companies, rather than reacting to short-term market fluctuations.

Regulatory Landscape and its Influence on Quantum AI Investment Decisions

The regulatory landscape surrounding quantum AI is still evolving and presents both opportunities and challenges for investors. Government regulations concerning data privacy, cybersecurity, and the ethical implications of quantum technologies could significantly impact the growth and profitability of quantum AI companies. For example, strict regulations on the use of quantum computing in sensitive areas such as finance or healthcare could limit market access and slow down the adoption of the technology.

Conversely, supportive government policies, such as research funding and tax incentives, could accelerate the development and commercialization of quantum AI technologies. The lack of clear and consistent regulatory frameworks across different jurisdictions adds further complexity to investment decisions, requiring investors to carefully consider the potential impact of varying regulatory environments on their investments.

Investing in quantum AI presents both huge potential and significant risk. The technology is still nascent, but its impact will be transformative, especially in finance. Learn more about how this will play out by checking out this article on How quantum AI will revolutionize financial modeling and prediction. Ultimately, early investment could yield massive returns, but careful due diligence is crucial to navigate the inherent uncertainties of this emerging field.

Macroeconomic Factors and their Influence on Quantum AI Companies

Macroeconomic factors, such as interest rates, inflation, and economic growth, can significantly influence the growth and profitability of quantum AI companies. During periods of economic uncertainty or recession, investors tend to be more risk-averse and may reduce their investments in emerging technologies like quantum AI. This can lead to a decline in funding for quantum AI startups and a slowdown in the development of the technology.

Conversely, periods of economic growth and low interest rates can stimulate investment in innovative technologies, potentially accelerating the development and commercialization of quantum AI. For instance, during periods of high inflation, the cost of research and development for quantum technologies may increase, potentially impacting the profitability of quantum AI companies. Similarly, government spending on research and development can significantly influence the growth of the quantum AI industry.

Ethical and Societal Implications

The convergence of quantum computing and artificial intelligence promises unprecedented advancements, but also raises significant ethical and societal concerns. The immense power of quantum AI necessitates careful consideration of its potential impact on various aspects of human life, from individual privacy to global security. Failing to address these issues proactively could lead to unforeseen and potentially harmful consequences.

Potential Ethical Concerns Surrounding Quantum AI Development and Application

The development and deployment of quantum AI present several ethical dilemmas. One key concern is the potential for bias amplification. Quantum algorithms, while powerful, are trained on data, and if that data reflects existing societal biases, the resulting AI system will likely perpetuate and even exacerbate those biases. This could lead to unfair or discriminatory outcomes in areas like loan applications, hiring processes, and even criminal justice.

Investing in quantum AI presents both huge potential and significant risk. The technology is still nascent, but early adoption could yield massive returns. One exciting application highlighted by this article, Quantum AI’s potential in solving optimization problems in logistics , showcases the industry’s transformative power. However, the long development timelines and uncertain regulatory landscape mean investors need to carefully weigh the potential rewards against the considerable risks involved.

Furthermore, the opacity of some quantum algorithms makes it difficult to understand their decision-making processes, hindering accountability and raising concerns about transparency and explainability. The potential for misuse in areas such as autonomous weapons systems or sophisticated surveillance technologies also presents a significant ethical challenge. Finally, the concentration of quantum AI expertise and resources in the hands of a few powerful entities raises concerns about equitable access and the potential for technological monopolies.

Societal Impact of Quantum AI: Positive and Negative Aspects

Quantum AI has the potential to revolutionize numerous sectors, leading to significant societal benefits. In healthcare, it could accelerate drug discovery and personalized medicine, leading to improved treatments and better health outcomes. In materials science, it could enable the design of novel materials with enhanced properties, leading to breakthroughs in energy, transportation, and manufacturing. In finance, it could improve risk management and algorithmic trading, potentially leading to greater efficiency and stability.

Investing in quantum AI presents huge potential, but it’s a high-risk, high-reward game. The technology is still developing, and success hinges on breakthroughs in several areas. To fully grasp the challenges and opportunities, understanding the current state of the field is crucial; check out this article on Understanding the quantum supremacy debate in the context of AI for more insight.

This debate directly impacts the timeline and viability of various quantum AI investment strategies, ultimately influencing the overall risk profile.

However, there are also potential downsides. The automation potential of quantum AI could lead to significant job displacement in various sectors, requiring proactive measures for workforce retraining and social safety nets. Furthermore, the increased computational power could be exploited for malicious purposes, such as sophisticated cyberattacks or the creation of more potent disinformation campaigns. The concentration of power associated with advanced quantum AI technologies could also exacerbate existing inequalities, both within and between nations.

Potential Biases in Quantum AI Algorithms and Their Consequences

The potential for bias in quantum AI algorithms is a critical concern. Because these algorithms are trained on data, any biases present in that data will be reflected in the algorithm’s outputs. For example, if a quantum AI system is trained on historical loan application data that reflects existing racial or gender biases, it may perpetuate these biases by denying loans to qualified applicants from underrepresented groups.

Similarly, a quantum AI system used in hiring could discriminate against certain candidates based on factors such as age or ethnicity if the training data contains such biases. The consequences of these biases can be far-reaching, leading to unfair and discriminatory outcomes that reinforce existing societal inequalities. Addressing this challenge requires careful data curation, algorithmic transparency, and ongoing monitoring and evaluation of quantum AI systems for bias.

Ethical Guidelines for Responsible Quantum AI Development and Deployment

| Principle | Description | Implementation | Example |

|---|---|---|---|

| Transparency and Explainability | Algorithms should be designed to be understandable and auditable. | Develop methods for interpreting and explaining quantum AI decisions. | Employ techniques like quantum circuit simulation and visualization to understand the decision-making process. |

| Fairness and Non-discrimination | Systems should be designed to avoid perpetuating or amplifying existing biases. | Implement bias detection and mitigation techniques during data collection and algorithm development. | Use diverse and representative datasets, and regularly audit the system for bias. |

| Privacy and Security | Data privacy and security must be prioritized throughout the lifecycle of the system. | Implement robust data encryption and access control mechanisms. | Use differential privacy techniques to protect sensitive information while still enabling useful analysis. |

| Accountability and Responsibility | Clear lines of responsibility should be established for the development and deployment of quantum AI. | Develop clear protocols for addressing errors, malfunctions, and ethical violations. | Establish independent oversight boards to review the development and deployment of high-impact quantum AI systems. |

Future Trends and Predictions: Investment Opportunities And Risks In The Quantum AI Industry

The convergence of quantum computing and artificial intelligence is poised to revolutionize numerous fields over the next decade. While still in its nascent stages, quantum AI holds the potential to surpass the capabilities of classical AI in solving currently intractable problems, leading to significant advancements across various sectors. This section explores anticipated breakthroughs, future applications, and potential market scenarios for quantum AI.

Projected Advancements in Quantum AI Technology

Significant progress is expected in the development of more stable and scalable quantum computers. This includes advancements in qubit coherence times, error correction techniques, and the development of fault-tolerant quantum computers. For example, the ongoing research into topological qubits and trapped ion systems promises to overcome some of the major hurdles currently limiting quantum computation. Increased investment in quantum hardware and software will accelerate these developments, potentially leading to quantum computers with significantly more qubits and improved performance within the next 5-10 years.

This increased capacity will unlock new algorithms and applications currently beyond the reach of classical computers. Furthermore, the development of hybrid quantum-classical algorithms, which combine the strengths of both classical and quantum computing, will play a crucial role in making quantum AI accessible and practical for a wider range of applications.

Potential Breakthroughs and Their Impact

One potential breakthrough is the development of quantum machine learning algorithms that can significantly outperform classical algorithms in specific tasks. For instance, quantum algorithms could revolutionize drug discovery by accelerating the identification of novel drug candidates and optimizing their design. Similarly, advancements in quantum optimization algorithms could optimize complex logistics networks, leading to significant improvements in efficiency and cost savings.

The development of quantum natural language processing could lead to breakthroughs in machine translation and information retrieval, resulting in more accurate and nuanced understanding of human language. These breakthroughs will not only enhance existing technologies but also create entirely new applications previously unimaginable.

Future Applications of Quantum AI Across Sectors

Quantum AI is expected to transform various sectors. In finance, quantum algorithms could revolutionize portfolio optimization, risk management, and fraud detection. In materials science, quantum simulations could accelerate the discovery of new materials with improved properties, such as high-temperature superconductors. In healthcare, quantum AI could lead to more accurate disease diagnostics, personalized medicine, and the development of novel therapies.

The automotive industry could benefit from quantum AI-powered autonomous driving systems with improved safety and efficiency. Furthermore, advancements in quantum AI could contribute to tackling global challenges such as climate change through improved energy efficiency and the development of sustainable technologies.

Projected Evolution of the Quantum AI Market

Over the next 5-10 years, the quantum AI market is projected to experience substantial growth. Early adoption is likely to be concentrated in sectors with high computational demands and a willingness to invest in cutting-edge technology. However, as quantum computing technology matures and becomes more accessible, broader adoption across various industries is expected. The market will likely witness increased competition among quantum computing companies, leading to innovation and price reductions.

The emergence of new business models and collaborations between quantum computing companies and industry partners will further shape the market landscape. While significant challenges remain, the potential rewards of quantum AI are substantial, making it a compelling area for investment and further research.

Final Summary

The quantum AI industry stands at a fascinating crossroads. While the potential rewards are immense, investors must carefully weigh the technological, financial, and ethical risks involved. Understanding the current market landscape, identifying promising investment opportunities, and proactively mitigating potential challenges are crucial for navigating this dynamic sector successfully. As quantum computing technology continues to advance, the landscape will undoubtedly evolve, presenting both new opportunities and unforeseen risks.

A proactive and informed approach is key to successfully harnessing the transformative power of quantum AI while mitigating potential downsides.

Question Bank

What is the biggest technological hurdle facing quantum AI development?

Maintaining quantum coherence – the delicate state required for quantum computations – for extended periods remains a significant challenge. Environmental noise can disrupt this state, limiting the complexity of problems that can be solved.

How does quantum AI compare to classical AI in terms of investment risk?

Quantum AI investments are inherently riskier than investments in established classical AI due to the nascent stage of the technology. Returns are potentially higher, but the likelihood of failure is also greater.

What role do governments play in the quantum AI landscape?

Governments worldwide are heavily investing in quantum computing research and development through grants and funding initiatives, recognizing its strategic importance for national competitiveness and security.

Are there ethical guidelines for quantum AI development?

While still evolving, discussions around ethical guidelines for quantum AI are underway, focusing on issues like bias mitigation, data privacy, and the potential for misuse of the technology.