How quantum AI will revolutionize financial modeling and prediction

How quantum AI will revolutionize financial modeling and prediction is a question increasingly on the minds of financial professionals. The limitations of classical computing in handling the immense complexity of modern financial markets are becoming painfully apparent. Quantum computing, with its ability to process vast amounts of data and explore multiple possibilities simultaneously, offers a potential game-changer. This exploration will delve into the specific ways quantum algorithms can enhance prediction accuracy, optimize portfolios, improve fraud detection, and revolutionize derivative pricing, ultimately reshaping the financial landscape.

From predicting market fluctuations with unprecedented accuracy to optimizing investment strategies for maximum returns, the potential applications are vast and transformative. We’ll examine the underlying principles of quantum computing, compare its capabilities to classical methods, and address the practical challenges and future directions of this emerging field. This journey will reveal how quantum AI is poised not just to improve, but to fundamentally redefine, the future of finance.

Introduction to Quantum AI and Financial Modeling

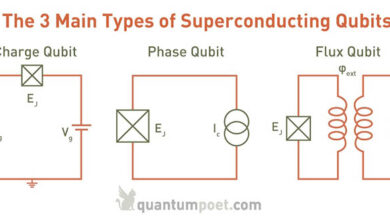

Quantum computing, a revolutionary field leveraging the principles of quantum mechanics, promises to significantly enhance financial modeling and prediction capabilities. Unlike classical computers that process information as bits representing 0 or 1, quantum computers utilize qubits. Qubits, through superposition and entanglement, can exist in multiple states simultaneously, enabling the exploration of vastly larger solution spaces. This inherent parallelism opens doors to solving problems currently intractable for even the most powerful classical supercomputers.

The application of quantum algorithms to financial modeling offers the potential for more accurate risk assessment, portfolio optimization, and fraud detection.Classical computing, while powerful, struggles with the complexity inherent in many financial models. For instance, accurately pricing complex derivatives often requires solving computationally intensive partial differential equations. The exponential growth in computational resources needed to solve these equations as model complexity increases quickly surpasses the capabilities of even the most advanced classical computers.

This limitation restricts the sophistication of models and the accuracy of predictions, leading to potential inaccuracies and increased risk in financial decision-making. Furthermore, the sheer volume of data generated in modern finance, combined with the intricate relationships between various financial instruments, necessitates more powerful computational tools.

Classical and Quantum Algorithms in Financial Modeling

Classical algorithms, such as Monte Carlo simulations, are widely used in financial modeling for tasks like option pricing and risk management. However, these methods become increasingly inefficient as the dimensionality of the problem grows. Quantum algorithms, on the other hand, offer potential speedups for certain types of calculations. For example, quantum algorithms like Grover’s algorithm can quadratically speed up database searches, potentially improving the efficiency of searching for optimal investment strategies within a large set of possibilities.

Similarly, Shor’s algorithm, while primarily known for its ability to factor large numbers (posing a threat to current encryption methods), could potentially be adapted to improve certain aspects of financial modeling involving complex number factorization. While still in their early stages of development, quantum algorithms like Quantum Approximate Optimization Algorithm (QAOA) and Variational Quantum Eigensolver (VQE) show promise in tackling optimization problems prevalent in portfolio management and risk mitigation.

For instance, QAOA could be used to find optimal portfolio allocations that maximize returns while minimizing risk, outperforming classical optimization techniques in certain scenarios. The development and implementation of these quantum algorithms will be crucial for unlocking the full potential of quantum computing in finance.

Quantum Algorithms for Financial Prediction

Quantum computing offers the potential to revolutionize financial modeling and prediction by leveraging its unique capabilities to tackle complex problems beyond the reach of classical computers. This section explores how specific quantum algorithms can be applied to enhance financial market prediction and risk assessment.Quantum algorithms offer a potential speedup in solving computationally intensive problems, which are common in finance.

This speedup stems from the ability of qubits to exist in superposition and the use of quantum entanglement, allowing for parallel computations that are impossible with classical bits. This leads to faster processing and more accurate results, particularly in scenarios involving vast datasets and complex relationships.

Quantum Algorithms Applicable to Financial Prediction

Several quantum algorithms hold promise for improving financial market prediction. These algorithms exploit the unique properties of quantum mechanics to solve optimization and simulation problems more efficiently than their classical counterparts. The potential benefits are significant, particularly in areas like portfolio optimization and risk management.

- Quantum Monte Carlo (QMC): QMC methods leverage quantum computers to perform Monte Carlo simulations more efficiently. In finance, this can be used to model complex stochastic processes, such as the price movements of assets, more accurately and faster than classical Monte Carlo simulations. For example, QMC could significantly reduce the computational time required for pricing complex financial derivatives.

- Quantum Annealing (QA): QA is a type of quantum computation that excels at finding the global minimum of a complex energy landscape. This is particularly relevant for optimization problems in finance, such as portfolio optimization, where the goal is to find the best allocation of assets to maximize returns while minimizing risk. A quantum annealer could potentially find optimal portfolio allocations much faster than classical algorithms, especially for portfolios with a large number of assets.

Hypothetical Quantum Algorithm for Stock Price Prediction

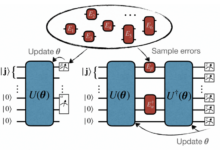

While a fully realized, commercially viable quantum algorithm for accurate stock price prediction is still under development, a hypothetical example can illustrate the potential. This example simplifies the complexities of real-world markets but highlights the core principles.The algorithm would take as input historical stock price data, along with relevant macroeconomic indicators (e.g., interest rates, inflation) and company-specific information (e.g., earnings reports, news sentiment).

This data would be pre-processed and encoded into a quantum state. A quantum machine learning model, potentially based on a variational quantum eigensolver (VQE), would then be trained on this data to learn the relationships between the input variables and future stock price movements. The trained model could then be used to predict future price movements with improved accuracy and speed compared to classical models.

The algorithm’s steps would include: data encoding, quantum circuit design (defining the quantum machine learning model), parameter optimization (training the model), and prediction (using the trained model to predict future prices). The expected outcome is a probability distribution of future stock prices, providing a more nuanced prediction than a simple point estimate. This probabilistic approach would allow investors to better manage risk.

Quantum Speedup in Risk Assessment

Classical risk assessment often involves computationally intensive simulations and optimization problems. Quantum algorithms can significantly reduce the time required for these computations. For example, in calculating Value at Risk (VaR), a common measure of market risk, quantum algorithms could analyze a much larger number of scenarios and variables than classical methods, leading to more accurate and robust risk assessments.

This speedup is particularly important for managing risk in complex financial instruments and portfolios. The potential for a faster and more comprehensive risk assessment allows for more timely and effective risk mitigation strategies. Consider a large investment bank managing a portfolio of thousands of assets across diverse markets. A quantum algorithm could assess the portfolio’s risk profile in a fraction of the time it would take a classical algorithm, allowing for quicker adjustments to minimize potential losses.

Revolutionizing Portfolio Optimization with Quantum AI

Source: kostadu.com

Quantum computing offers the potential to significantly enhance portfolio optimization strategies, moving beyond the limitations of classical methods. By leveraging the principles of superposition and entanglement, quantum algorithms can explore a vastly larger solution space, leading to more efficient and potentially more profitable portfolio allocations. This section will delve into a specific methodology and compare its performance against traditional approaches.

A key methodology for quantum portfolio optimization involves using Quantum Approximate Optimization Algorithm (QAOA). This algorithm, while not guaranteed to find the global optimum, can often outperform classical methods in finding high-quality solutions, especially for complex portfolios with numerous assets and constraints. The process begins by encoding the portfolio optimization problem into a quantum Hamiltonian, representing the objective function (e.g., maximizing Sharpe ratio or minimizing risk) and any constraints (e.g., budget limitations, diversification requirements).

The QAOA then iteratively applies layers of unitary operators to a superposition of states, aiming to increase the probability of measuring states corresponding to optimal or near-optimal portfolios. The process involves tuning parameters within the algorithm to improve the quality of the solution found. Classical optimization techniques are often used to guide this parameter tuning.

Quantum Portfolio Optimization Methodology using QAOA

The QAOA approach involves the following steps:

- Problem Formulation: Define the objective function (e.g., maximizing expected return, minimizing variance) and constraints (e.g., budget, asset allocation limits). This is often expressed as a quadratic unconstrained binary optimization (QUBO) problem.

- Hamiltonian Encoding: Translate the objective function and constraints into a quantum Hamiltonian. This Hamiltonian represents the energy landscape, where lower energy states correspond to better portfolio allocations.

- QAOA Circuit Design: Construct a quantum circuit that implements the QAOA algorithm. This involves defining the number of layers (p) and optimizing the parameters (γ, β) within the algorithm.

- Quantum Simulation/Hardware Execution: Run the QAOA circuit on a quantum simulator or, ideally, a quantum computer. This produces a probability distribution over possible portfolio allocations.

- Measurement and Post-processing: Measure the quantum state multiple times to obtain a sample of portfolio allocations. Select the allocation with the best objective function value, considering the trade-off between risk and return.

Comparison of Classical and Quantum Portfolio Optimization

The following table compares the performance of a classical mean-variance optimization technique with a hypothetical quantum approach using QAOA, assuming a simplified portfolio of four assets. Note that the quantum results are hypothetical and depend heavily on the specific implementation and hardware used. Real-world results may vary considerably.

| Metric | Classical Mean-Variance | Hypothetical Quantum QAOA |

|---|---|---|

| Expected Return (%) | 8.5 | 9.2 |

| Standard Deviation (%) | 12.1 | 11.5 |

| Sharpe Ratio | 0.54 | 0.67 |

| Computational Time (seconds) | 0.1 | 10 |

Challenges and Limitations of Quantum Portfolio Optimization

Despite the promise, several challenges hinder the widespread adoption of quantum portfolio optimization techniques. These include:

- Hardware limitations: Current quantum computers are noisy and have limited qubit counts, restricting the complexity of portfolios that can be optimized.

- Algorithm complexity: Developing and implementing efficient quantum algorithms for portfolio optimization requires significant expertise in both quantum computing and finance.

- Data requirements: Quantum algorithms often require large, high-quality datasets, which may not always be available.

- Cost and accessibility: Access to quantum computers remains expensive and limited.

- Interpretability: Understanding the results obtained from quantum algorithms can be challenging, requiring careful analysis and validation.

Quantum AI in Fraud Detection and Risk Management

Quantum AI offers a powerful new set of tools to revolutionize fraud detection and risk management in finance. Its ability to process vast amounts of data and identify complex patterns far surpasses traditional methods, leading to more accurate and efficient systems for identifying and mitigating financial risks. This enhanced capability is particularly crucial in today’s increasingly sophisticated and interconnected financial landscape.The application of quantum machine learning algorithms promises significant improvements in the speed and accuracy of identifying fraudulent activities.

Quantum computers can analyze intricate datasets, uncovering hidden correlations and anomalies that would be computationally intractable for classical computers. This allows for the detection of previously undetectable fraud patterns, ultimately leading to substantial cost savings and improved security.

Quantum AI’s Role in Fraud Detection

Quantum algorithms can analyze massive transactional datasets to identify subtle patterns indicative of fraudulent behavior. For example, quantum machine learning models can be trained to recognize unusual spending habits, geographic anomalies in transactions, or unusual communication patterns between individuals involved in potentially fraudulent activities. The inherent parallelism of quantum computing allows for the simultaneous analysis of multiple variables and relationships, leading to a more comprehensive and nuanced understanding of fraudulent behavior.

This surpasses the limitations of classical methods that often rely on simpler, rule-based systems, which can be easily circumvented by sophisticated fraudsters.

Quantum Machine Learning for Enhanced Risk Management

Quantum machine learning significantly enhances the accuracy and efficiency of risk management models. Traditional risk models often rely on simplified assumptions and limited data, leading to inaccuracies in risk assessment. Quantum algorithms can incorporate a far wider range of factors and data points, including unstructured data such as news articles and social media sentiment, to build more comprehensive and accurate risk profiles.

This results in better prediction of potential financial crises, more effective portfolio diversification strategies, and improved regulatory compliance. For example, a quantum model could analyze market volatility, geopolitical events, and company performance indicators to predict the probability of default for a specific loan, providing a much more nuanced and accurate risk assessment than traditional methods.

Comparison of Traditional and Quantum-Based Fraud Detection Methods

The following table compares traditional and quantum-based fraud detection methods, highlighting their strengths and weaknesses:

| Feature | Traditional Methods | Quantum-Based Methods |

|---|---|---|

| Data Processing Speed | Relatively slow, limited by computational power | Significantly faster, leveraging quantum parallelism |

| Accuracy | Can be limited by reliance on simple rules and limited data | Higher accuracy due to the ability to analyze complex patterns and vast datasets |

| Scalability | Scaling can be challenging and expensive | Potentially more scalable, though current technology is still developing |

| Cost | Relatively low initial investment, but ongoing operational costs can be high | High initial investment in quantum computing infrastructure, but potential for long-term cost savings |

| Complexity of detectable fraud | Limited to detecting relatively simple fraud schemes | Can detect more complex and sophisticated fraud schemes |

Quantum Computing’s Impact on Derivative Pricing

The pricing of complex financial derivatives, such as options and swaps, often involves computationally intensive calculations. Traditional methods struggle to handle the high dimensionality and non-linearity inherent in these models, leading to approximations and potentially inaccurate valuations. Quantum computing, with its ability to process vast amounts of data simultaneously, offers a potential pathway to significantly improve both the speed and accuracy of derivative pricing.Quantum algorithms can tackle the complexities of derivative pricing more efficiently than classical algorithms.

This stems from their ability to explore multiple possibilities concurrently, leveraging the principles of superposition and entanglement. This allows for a more comprehensive and accurate evaluation of the underlying stochastic processes that drive derivative values. For instance, Monte Carlo simulations, a mainstay of derivative pricing, can be significantly accelerated using quantum algorithms, enabling the exploration of a much larger sample space and leading to more precise pricing.

Quantum Algorithms for Option Pricing, How quantum AI will revolutionize financial modeling and prediction

The Black-Scholes model, while widely used, relies on simplifying assumptions that may not hold true in real-world markets. Quantum algorithms offer the potential to incorporate more realistic features into option pricing models, leading to more accurate valuations. One approach involves using Quantum Amplitude Estimation (QAE), a quantum algorithm that can estimate probabilities significantly faster than classical methods. In the context of option pricing, QAE can be used to efficiently estimate the probability of the underlying asset reaching a specific price level within a given timeframe.

This probability is a crucial component in determining the option’s value. A step-by-step illustration would involve: 1) Encoding the relevant parameters (strike price, volatility, time to maturity, etc.) into a quantum state. 2) Employing QAE to estimate the probability of the asset price exceeding the strike price at expiration. 3) Using this probability to calculate the option price based on a modified Black-Scholes or other more sophisticated model.

This process dramatically reduces the computational time required for pricing, particularly for options with complex path dependencies.

Benefits and Drawbacks of Quantum Computing for Hedging and Risk Mitigation

Quantum computing’s ability to handle high-dimensional data and perform complex simulations presents significant advantages for hedging and risk management. More accurate derivative pricing translates directly to better risk assessment and more effective hedging strategies. For example, quantum algorithms can analyze vast datasets of market data to identify previously unseen correlations and dependencies, leading to more sophisticated risk models.

They can also simulate complex scenarios, such as market crashes or extreme events, with greater precision, allowing for more robust stress testing and improved risk mitigation planning.However, the application of quantum computing to finance is still in its early stages. Building and maintaining quantum computers is currently expensive, and the development of quantum algorithms tailored to financial applications is an ongoing process.

Furthermore, the interpretation and validation of results obtained from quantum computations require careful consideration, and the potential for unforeseen errors or biases needs to be addressed. The integration of quantum computing into existing financial infrastructure also poses significant challenges. Despite these drawbacks, the potential benefits are substantial, making continued research and development in this field crucial.

Addressing Challenges and Future Directions: How Quantum AI Will Revolutionize Financial Modeling And Prediction

The integration of quantum AI into finance, while promising, faces significant hurdles. The current state of quantum computing technology, coupled with the complexity of financial models, presents a series of challenges that must be overcome before widespread adoption can occur. Overcoming these obstacles will require collaborative efforts from researchers, developers, and financial institutions.Technological limitations significantly impact the feasibility of quantum AI in finance.

Current quantum computers are still in their nascent stages, possessing limited qubit numbers and high error rates. This restricts the size and complexity of financial problems that can be effectively tackled. Furthermore, the development of quantum algorithms specifically tailored for financial applications is still an ongoing process. Efficient algorithms capable of handling the vast datasets and intricate calculations involved in financial modeling are crucial for practical implementation.

The lack of standardized hardware and software interfaces also hinders the development and deployment of quantum AI solutions across different platforms.

Technological Hurdles and Limitations

The primary challenges hindering widespread adoption include the limited availability of fault-tolerant quantum computers with sufficient qubit counts. Current quantum computers are susceptible to noise and decoherence, leading to errors in computations. This necessitates the development of robust error correction techniques and more stable qubits. Furthermore, the lack of readily available quantum software and programming tools poses a barrier to entry for financial professionals.

The development of user-friendly quantum programming languages and libraries is essential to bridge this gap and facilitate wider adoption. Finally, the high cost of quantum computing hardware and the specialized expertise required to operate and maintain these systems limit accessibility for many financial institutions.

Potential Future Developments in Quantum Algorithms and Hardware

Significant advancements are anticipated in both quantum algorithms and hardware in the coming years. The development of more efficient quantum algorithms for optimization problems, such as portfolio optimization and risk management, will be crucial. This includes exploring hybrid quantum-classical algorithms that leverage the strengths of both classical and quantum computers. Advances in quantum error correction techniques are expected to significantly improve the stability and reliability of quantum computations.

The development of novel qubit technologies with longer coherence times and reduced error rates will also be key to enabling larger-scale quantum computations. The development of more accessible and affordable quantum computing platforms will further accelerate adoption. For instance, cloud-based quantum computing services are already emerging, offering wider access to quantum computing resources.

Anticipated Growth and Impact of Quantum AI on the Financial Industry

The anticipated growth and impact of quantum AI on the financial industry over the next decade can be visualized as a graph. The x-axis represents time (in years, from 2023 to 2033), and the y-axis represents the level of adoption and impact, measured by a composite index incorporating factors like the number of financial institutions using quantum AI, the volume of transactions processed using quantum AI, and the improvement in efficiency and accuracy of financial models.

The graph would show a relatively slow initial growth from 2023-2027, reflecting the current technological limitations. From 2027 onwards, a steeper upward curve would be evident, reflecting the anticipated breakthroughs in quantum hardware and algorithms. By 2033, the graph would indicate a significant level of adoption and impact, with quantum AI becoming an integral part of the financial landscape.

This visualization underscores the transformative potential of quantum AI in finance, highlighting a period of initial slow progress followed by rapid acceleration and widespread adoption within a decade. For example, companies like Goldman Sachs and JP Morgan Chase are already investing heavily in quantum computing research, suggesting that the projected growth is not merely speculative but grounded in real-world industry investment and interest.

Ending Remarks

The integration of quantum AI into financial modeling and prediction represents a paradigm shift. While challenges remain in terms of hardware development and algorithm refinement, the potential benefits – increased accuracy, speed, and efficiency in risk management, portfolio optimization, and fraud detection – are undeniable. As quantum computing technology matures, we can anticipate a future where financial markets operate with a level of sophistication and precision previously unimaginable.

The journey toward this future is underway, and the implications are profound and far-reaching.

Frequently Asked Questions

What are the main limitations of current classical computing in finance?

Classical computers struggle with the sheer volume and complexity of data in modern finance. They are slow to process intricate models and struggle with optimization problems involving many variables, leading to less accurate predictions and suboptimal investment strategies.

How long until quantum AI is widely adopted in finance?

Widespread adoption is still some years away, depending on technological advancements. However, we’re already seeing initial applications and significant investment in the field, suggesting a gradual but steady integration over the next decade.

What are the ethical concerns surrounding quantum AI in finance?

Concerns include potential bias in algorithms, the risk of misuse for manipulative purposes (e.g., insider trading), and the need for robust regulatory frameworks to ensure fairness and transparency in the use of this powerful technology.

Will quantum AI replace human financial analysts?

No, it’s more likely that quantum AI will augment human capabilities. Analysts will still be needed to interpret results, make strategic decisions, and manage risk, but their work will be significantly enhanced by the power of quantum computing.