Blockchain Security A Comprehensive Overview

Blockchain security is paramount in the ever-expanding digital landscape. Understanding its intricacies is crucial for navigating the complexities of this transformative technology. This exploration delves into the fundamental components of blockchain, examining its cryptographic underpinnings and the various consensus mechanisms that govern its operation. We’ll dissect common attack vectors, analyze vulnerabilities, and explore robust security measures, including best practices for key management and smart contract development.

From regulatory compliance to the looming threat of quantum computing, we’ll navigate the multifaceted challenges and emerging trends shaping the future of blockchain security. Case studies of past breaches will illuminate the critical lessons learned and highlight the importance of proactive security measures. The goal is to provide a comprehensive understanding of the security landscape, empowering readers to confidently engage with this revolutionary technology.

Blockchain Fundamentals

Blockchain technology, at its core, is a distributed, immutable ledger that records and verifies transactions across a network of computers. Its security and efficiency stem from a combination of cryptographic techniques and consensus mechanisms. Understanding these fundamentals is crucial to appreciating the overall security posture of a blockchain system.

Core Components of a Blockchain System

A blockchain system comprises several interconnected components working in harmony. These include blocks, which are containers holding transaction data; a chain, which links these blocks chronologically using cryptographic hashes; a network of nodes, which are computers participating in the validation and maintenance of the blockchain; and a consensus mechanism, which determines how new blocks are added to the chain. The interaction of these components creates a secure and transparent system.

Each block contains a timestamp, a cryptographic hash of the previous block, and the transaction data itself. This linking of blocks via hashes creates the chain’s immutability – altering one block would require altering all subsequent blocks, a computationally infeasible task. The network of nodes ensures decentralization and redundancy, preventing single points of failure.

Cryptographic Principles Underpinning Blockchain Security

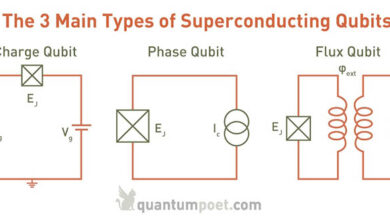

Blockchain security relies heavily on established cryptographic principles. Hashing algorithms, such as SHA-256, play a vital role in ensuring data integrity. These algorithms produce unique, fixed-size outputs (hashes) for any given input. A slight change in the input results in a drastically different hash, making data tampering readily detectable. Digital signatures, based on public-key cryptography, authenticate transactions and prevent unauthorized modifications.

Each participant possesses a pair of keys: a private key for signing transactions and a public key for verifying signatures. The use of these cryptographic techniques ensures the authenticity and integrity of data stored on the blockchain.

Comparison of Consensus Mechanisms and Their Security Implications

Different blockchain networks employ various consensus mechanisms to validate transactions and add new blocks to the chain. The choice of mechanism significantly impacts the network’s security and performance characteristics. Proof-of-Work (PoW), Proof-of-Stake (PoS), and Delegated Proof-of-Stake (DPoS) are prominent examples. PoW, used in Bitcoin, relies on computational power to solve complex cryptographic puzzles. PoS, used in Ethereum 2.0, allows users to validate transactions based on the number of coins they stake.

DPoS delegates validation rights to elected representatives. Each mechanism presents trade-offs between security, scalability, and energy consumption.

Consensus Mechanism Comparison

| Algorithm | Strengths | Weaknesses | Security Level |

|---|---|---|---|

| Proof-of-Work (PoW) | High security, decentralized, resistant to 51% attacks (with sufficient hash rate) | High energy consumption, slow transaction speeds, potential for centralization through mining pools | High |

| Proof-of-Stake (PoS) | Lower energy consumption, faster transaction speeds, potential for greater decentralization | Vulnerable to “nothing-at-stake” attacks (mitigated by various mechanisms), potential for wealth concentration | Medium-High |

| Delegated Proof-of-Stake (DPoS) | Fast transaction speeds, relatively low energy consumption | Less decentralized, vulnerable to attacks targeting delegates, potential for collusion among delegates | Medium |

Types of Blockchain Attacks

Blockchain technology, while robust, is not impervious to attack. Various vulnerabilities exist within the network and its constituent components, making understanding these attack vectors crucial for maintaining the security and integrity of blockchain systems. This section details common attack types, focusing on their mechanisms and potential consequences.

51% Attacks

A 51% attack, also known as a majority attack, occurs when a single entity or a group of colluding entities controls more than 50% of the network’s hashing power. This allows them to manipulate the blockchain’s consensus mechanism, potentially reversing transactions, preventing legitimate transactions from being confirmed, or even creating double-spending scenarios. The consequences of a successful 51% attack can be devastating, leading to significant financial losses and erosion of trust in the affected blockchain.

For example, a 51% attack could allow an attacker to double-spend cryptocurrency, effectively spending the same coins twice. The success of such an attack hinges on the attacker’s ability to acquire sufficient computational resources to surpass the combined hashing power of the rest of the network. The difficulty of this attack increases proportionally with the size and decentralization of the network.

Smart Contract Vulnerabilities

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, introduce new vulnerabilities. Bugs in the code, often stemming from poorly written or inadequately tested smart contracts, can be exploited by malicious actors. These vulnerabilities can range from simple logic errors that allow unauthorized access to funds to complex exploits that drain entire pools of cryptocurrency.

The DAO hack in 2016, where millions of dollars worth of Ether were stolen due to a vulnerability in the DAO smart contract, serves as a stark example of the potential consequences. Common vulnerabilities include reentrancy attacks, where a contract calls itself recursively to drain funds, and overflow/underflow errors, which occur when arithmetic operations exceed the maximum or minimum values a variable can hold.

Sybil Attacks

A Sybil attack involves creating numerous fake identities (Sybil nodes) to gain undue influence on a network. In a blockchain context, this could allow an attacker to manipulate voting mechanisms, influence consensus, or even launch a 51% attack more easily by appearing to have a larger share of the network than they actually do. The attacker essentially creates a large number of seemingly independent nodes, all controlled by a single entity.

Flowchart: Sybil Attack Stages

A typical Sybil attack unfolds in several stages. The following flowchart illustrates these stages:[Imagine a flowchart here. The flowchart would have boxes representing the following stages:

- Attacker acquires multiple IP addresses/identities.

- Attacker registers numerous fake nodes on the network.

- Attacker uses fake nodes to manipulate network consensus or voting.

- Attacker achieves desired outcome (e.g., manipulating transaction confirmations, influencing governance decisions).

Arrows would connect these boxes, showing the progression of the attack.]

Denial-of-Service (DoS) Attacks

Denial-of-service attacks aim to disrupt the normal functioning of a blockchain network by overwhelming it with traffic. This can prevent legitimate users from accessing the network or participating in transactions. While not directly targeting the blockchain’s underlying data integrity, DoS attacks can significantly impact its usability and availability. A distributed denial-of-service (DDoS) attack, launched from multiple sources, is particularly effective in crippling a network’s ability to process transactions.

Mitigation strategies often involve robust network infrastructure and distributed consensus mechanisms designed to withstand such attacks.

Security Measures and Best Practices

Source: globalknowledge.com

Robust security practices are paramount for the successful and trustworthy operation of blockchain systems. Protecting the underlying infrastructure and user assets requires a multi-layered approach encompassing both technical and procedural safeguards. This section details crucial security measures and best practices for individuals and organizations operating within the blockchain ecosystem.

Private Key and Wallet Security

Safeguarding private keys is the cornerstone of blockchain security. Compromised private keys grant immediate access to the associated cryptocurrency holdings. Best practices include employing strong, randomly generated passwords or using hardware wallets that store keys offline, minimizing the risk of digital theft. Regularly backing up private keys (preferably using multiple, geographically diverse methods) is also vital, mitigating the impact of device loss or failure.

Additionally, users should be wary of phishing scams and malicious software designed to steal private keys. Never share your private keys with anyone, and always verify the legitimacy of websites and applications before entering sensitive information.

Multi-Signature Wallets

Multi-signature wallets enhance security by requiring multiple private keys to authorize transactions. This approach significantly reduces the risk of unauthorized access. For instance, a 2-of-3 multi-signature wallet requires any two out of three designated private keys to approve a transaction. This distribution of control among multiple individuals or entities increases resilience against theft or compromise of a single key.

The complexity of obtaining all necessary signatures for a transaction creates a significant barrier to unauthorized spending, making multi-signature wallets particularly suitable for managing large sums of cryptocurrency or shared organizational funds. Implementing multi-signature wallets involves careful consideration of key management and the allocation of signing authority among participants.

Smart Contract Security

Securing smart contracts requires a comprehensive approach encompassing careful design, rigorous testing, and continuous monitoring. Formal verification techniques, such as model checking, can help identify potential vulnerabilities in the smart contract’s logic before deployment. Thorough code reviews by experienced developers are crucial to detect subtle flaws that might be missed by automated tools. Using established and well-audited libraries reduces the risk of introducing vulnerabilities from external code.

Furthermore, regular security audits and penetration testing should be performed to proactively identify and address potential weaknesses. Deploying smart contracts on well-established and reputable blockchain platforms that offer robust security features also significantly mitigates risk. Contracts should be designed with a clear understanding of potential attack vectors and incorporate mechanisms to mitigate those risks, such as input validation and access control lists.

Security Audits and Penetration Testing, Blockchain security

Regular security audits and penetration testing are essential for maintaining the integrity and resilience of blockchain systems. Security audits involve systematic reviews of the codebase and system architecture to identify potential vulnerabilities. Penetration testing simulates real-world attacks to assess the effectiveness of security measures and identify weaknesses that might be exploited by malicious actors. Various methods are employed, including static analysis (analyzing code without execution), dynamic analysis (analyzing code during execution), and fuzzing (providing unexpected inputs to identify vulnerabilities).

These audits and tests should be conducted by independent, qualified security professionals with expertise in blockchain technology. The results of these assessments inform the development of mitigation strategies and improvements to the system’s overall security posture. A comprehensive approach involves both automated tools and manual code reviews to achieve a high level of confidence in the system’s security.

Regulatory and Legal Aspects

The intersection of blockchain technology and the law is a rapidly evolving field, presenting both opportunities and challenges. The decentralized and transparent nature of blockchain, while offering advantages in security and efficiency, also creates complexities for regulators seeking to ensure compliance and protect consumers. This section explores the current regulatory landscape, legal implications of security failures, and potential legal frameworks for addressing blockchain-related incidents.The regulatory landscape surrounding blockchain security and compliance varies significantly across jurisdictions.

Some countries have embraced a relatively permissive approach, focusing on fostering innovation while others have implemented stricter regulations to mitigate risks. This disparity creates uncertainty for businesses operating in the blockchain space, requiring them to navigate a complex web of differing legal requirements. For example, the European Union’s Markets in Crypto-assets (MiCA) regulation provides a comprehensive framework for crypto-asset service providers, while the United States currently lacks a unified national approach, leading to a patchwork of state-level regulations.

The Legal Implications of Blockchain Vulnerabilities and Breaches

Blockchain vulnerabilities, whether stemming from smart contract flaws, private key compromises, or exchange hacks, can have significant legal repercussions. Breaches can lead to substantial financial losses for users and investors, triggering lawsuits alleging negligence, fraud, or breach of contract. Companies operating blockchain-based platforms face potential liability for security failures, particularly if they fail to implement adequate security measures or to disclose vulnerabilities promptly.

Furthermore, regulatory bodies may impose fines or other penalties for non-compliance with existing laws and regulations. For example, a data breach involving personal information stored on a blockchain could trigger legal action under data protection laws like GDPR.

Potential Legal Frameworks for Addressing Blockchain-Related Security Incidents

Several legal frameworks are emerging to address blockchain-related security incidents. Existing laws concerning fraud, theft, and data protection often apply, but their applicability to the unique characteristics of blockchain technology is still being tested. Contract law plays a significant role, defining the responsibilities and liabilities of parties involved in blockchain transactions. Furthermore, some jurisdictions are exploring the development of specific regulations for blockchain security, aiming to establish clear guidelines and standards for the industry.

The ongoing development of these frameworks necessitates a proactive approach by businesses to stay informed and adapt their practices accordingly.

Key Legal Considerations for Blockchain Projects

Understanding the legal landscape is crucial for the success and longevity of any blockchain project. Careful consideration of the following points is paramount:

- Jurisdictional Compliance: Identifying and adhering to relevant regulations in all jurisdictions where the project operates.

- Smart Contract Security Audits: Undertaking thorough security audits of smart contracts to identify and mitigate potential vulnerabilities.

- Data Privacy and Protection: Implementing robust measures to protect user data and comply with data privacy regulations (e.g., GDPR, CCPA).

- Insurance and Risk Management: Obtaining appropriate insurance coverage to mitigate potential financial losses from security breaches.

- Dispute Resolution Mechanisms: Establishing clear and efficient mechanisms for resolving disputes arising from blockchain transactions.

- Intellectual Property Rights: Protecting intellectual property rights associated with the blockchain project.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Adhering to AML/KYC regulations to prevent the use of blockchain for illicit activities.

Future Trends in Blockchain Security

The security landscape of blockchain technology is constantly evolving, with new threats and vulnerabilities emerging alongside innovative solutions. Understanding these trends is crucial for maintaining the integrity and trustworthiness of blockchain systems. This section will explore emerging threats, the impact of quantum computing, and innovative security solutions currently under development.Emerging Threats and Vulnerabilities in Blockchain TechnologyBlockchain security faces an ever-growing array of challenges.

These range from well-known vulnerabilities like 51% attacks and Sybil attacks to more nuanced threats exploiting the intricacies of smart contracts and consensus mechanisms. Furthermore, the increasing integration of blockchain with other technologies expands the attack surface, creating opportunities for novel forms of exploitation. For instance, vulnerabilities in the interfaces connecting blockchain systems to traditional databases or applications can be leveraged to compromise the overall security.

Similarly, poorly designed smart contracts, often containing unforeseen loopholes, represent a significant risk, potentially leading to significant financial losses or data breaches.

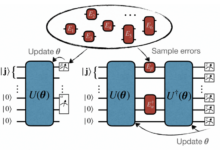

Quantum Computing’s Threat to Blockchain Security

Quantum computing’s potential to break widely used cryptographic algorithms poses a significant long-term threat to blockchain security. Current blockchain systems rely heavily on asymmetric cryptography, such as elliptic curve cryptography (ECC), to secure transactions and maintain the integrity of the blockchain. However, sufficiently powerful quantum computers could potentially break these algorithms, rendering current security measures ineffective. This would allow malicious actors to forge signatures, decrypt transactions, and potentially compromise the entire blockchain network.

While quantum-resistant cryptography is being actively researched and developed, its widespread adoption and integration into existing blockchain systems will take time and significant effort. The transition to quantum-resistant cryptography presents a major challenge, requiring careful planning and coordination across the entire blockchain ecosystem. For example, a hypothetical scenario could involve a quantum computer successfully factoring the large prime numbers underpinning the ECC used in Bitcoin, allowing a malicious actor to create counterfeit Bitcoins.

Innovative Security Solutions for Blockchain

The development of innovative security solutions is crucial to mitigating emerging threats and preparing for the quantum computing era. Several promising approaches are being actively explored. Zero-knowledge proofs (ZKPs) allow users to verify information without revealing the underlying data, enhancing privacy and security. Multi-party computation (MPC) enables multiple parties to jointly compute a function without revealing their individual inputs, protecting sensitive data during transactions.

Furthermore, advancements in consensus mechanisms, such as the exploration of more robust and decentralized consensus protocols, are improving the resilience of blockchain systems against attacks. The development and implementation of formal verification techniques for smart contracts are also vital in reducing the risk of vulnerabilities arising from coding errors. For example, the use of ZKPs in privacy-enhancing cryptocurrencies like Zcash allows for verifiable transactions without revealing the sender or receiver’s identities.

Future Research Directions in Blockchain Security

Future research in blockchain security should focus on several key areas. Developing and implementing post-quantum cryptography is paramount to ensure long-term security against quantum computing threats. Further research into more robust consensus mechanisms is also needed to improve the resilience of blockchain networks against various types of attacks. Significant efforts should be devoted to developing automated tools and techniques for identifying and mitigating vulnerabilities in smart contracts, potentially leveraging artificial intelligence and machine learning.

Finally, enhancing the security and privacy of decentralized applications (dApps) is crucial for fostering wider adoption and trust in blockchain technology. Research into techniques that combine different security measures, creating a layered security approach, is also a vital direction. For example, exploring the combination of ZKPs with MPC to enhance both privacy and security in decentralized finance (DeFi) applications represents a promising area of future research.

Case Studies of Blockchain Security Incidents

Blockchain technology, while lauded for its security, is not impervious to attacks. Several high-profile incidents have exposed vulnerabilities and highlighted the need for robust security measures. Examining these real-world examples provides valuable insights into the potential risks and the importance of proactive security strategies.

The DAO Hack

The DAO, a decentralized autonomous organization built on the Ethereum blockchain, suffered a significant hack in 2016. Exploiting a reentrancy vulnerability in its smart contract, an attacker drained approximately 3.6 million ETH (worth roughly $50 million at the time). The vulnerability allowed the attacker to repeatedly withdraw funds from The DAO’s contract before the transaction was fully processed. This incident exposed the critical importance of rigorous smart contract auditing and the potential consequences of vulnerabilities in decentralized applications.

The Ethereum network subsequently underwent a hard fork to reverse the transaction, a controversial decision that highlighted the tension between immutability and the need to address critical security flaws.

Mt. Gox Bitcoin Exchange Hack

Mt. Gox, once the world’s largest Bitcoin exchange, was the victim of a massive hack in 2014. Approximately 850,000 Bitcoins, worth billions of dollars at the time, were stolen. The hack was attributed to a combination of factors, including poor security practices, vulnerabilities in the exchange’s software, and potentially insider involvement. The lack of robust security measures, including multi-signature wallets and proper transaction monitoring, allowed the attackers to compromise the exchange and steal a significant portion of its Bitcoin reserves.

The fallout from this incident led to the bankruptcy of Mt. Gox and significantly damaged the reputation of the cryptocurrency industry.

Parity Multi-sig Wallet Vulnerability

In 2017, a critical bug in a Parity Technologies multi-signature wallet library allowed an attacker to freeze millions of dollars worth of Ether. The vulnerability stemmed from a coding error that allowed a user with specific permissions to unintentionally wipe out other wallets. This incident demonstrated the cascading effects of vulnerabilities in shared libraries and the importance of thorough code review and testing before deployment.

While not directly a blockchain vulnerability, the incident impacted the Ethereum ecosystem significantly and underscored the risks associated with relying on third-party libraries for critical functionalities.

| Incident | Cause | Impact |

|---|---|---|

| The DAO Hack | Reentrancy vulnerability in a smart contract | Loss of 3.6 million ETH, hard fork of the Ethereum network, damage to investor confidence |

| Mt. Gox Bitcoin Exchange Hack | Poor security practices, software vulnerabilities, potential insider involvement | Loss of 850,000 Bitcoins, bankruptcy of Mt. Gox, damage to cryptocurrency reputation |

| Parity Multi-sig Wallet Vulnerability | Coding error in a Parity Technologies library | Freezing of millions of dollars worth of Ether, disruption to the Ethereum ecosystem |

Blockchain Security Tools and Technologies

The robust security of blockchain networks relies heavily on a suite of specialized tools and technologies. These tools are crucial for detecting vulnerabilities, preventing attacks, and ensuring the integrity and confidentiality of blockchain data. This section explores the functionalities of key components within this ecosystem.

Blockchain Security Auditing Tools

Blockchain security auditing tools are designed to systematically examine blockchain networks for weaknesses and vulnerabilities. These tools leverage automated processes and advanced algorithms to identify potential security flaws, such as smart contract bugs, consensus mechanism vulnerabilities, and key management issues. A comprehensive audit typically involves static analysis (examining the code without execution) and dynamic analysis (executing the code and monitoring its behavior).

The results provide developers with actionable insights to improve the security posture of their blockchain systems. Reports generated by these tools often highlight specific lines of code containing vulnerabilities, outlining potential attack vectors and recommending remediation strategies. Examples include tools that check for reentrancy vulnerabilities in smart contracts or those that analyze the cryptographic algorithms used for ensuring the integrity of transactions.

Intrusion Detection Systems in Blockchain Networks

Intrusion detection systems (IDS) for blockchain networks monitor network traffic and system activity for malicious behavior. Unlike intrusion prevention systems (IPS), which actively block malicious activity, IDSs primarily focus on detecting suspicious events and alerting administrators. Several types are applicable to blockchain networks. Network-based IDSs monitor network packets for patterns indicative of attacks, such as denial-of-service (DoS) attempts or unauthorized access attempts.

Host-based IDSs monitor the activity on individual nodes within the blockchain network, looking for signs of compromise, such as unauthorized code execution or data modification. Behavior-based IDSs analyze the overall behavior of the blockchain network to identify anomalies that might indicate an attack. For example, a sudden surge in transaction volume or a significant deviation from the normal transaction pattern could trigger an alert.

Anomaly-based IDSs focus on detecting deviations from established baselines of normal network behavior, thus identifying unusual patterns that could signal an attack.

Cryptographic Techniques in Blockchain Security

Blockchain security heavily relies on various cryptographic techniques to ensure data integrity, confidentiality, and authenticity. Public-key cryptography, which utilizes a pair of keys (a public key and a private key), is fundamental. The public key is used for verifying digital signatures and encrypting data, while the private key is kept secret and used for signing transactions and decrypting data.

Hashing algorithms, such as SHA-256, create unique fingerprints (hashes) of data blocks. These hashes are crucial for ensuring data integrity, as any alteration to the data will result in a different hash value. Digital signatures, created using private keys, provide authentication and non-repudiation. They guarantee that a transaction originated from a specific entity and cannot be denied later.

Elliptic curve cryptography (ECC) is another widely used technique, offering strong security with relatively shorter key lengths compared to RSA. Zero-knowledge proofs allow one party to prove the truth of a statement without revealing any other information. This is useful in various blockchain applications, for example, verifying identity without exposing sensitive data. The choice of cryptographic techniques depends on the specific security requirements and performance considerations of the blockchain system.

Blockchain Security Platforms and Their Features

Several platforms provide comprehensive security solutions for blockchain networks. These platforms offer a range of features, including smart contract auditing tools, vulnerability scanners, intrusion detection systems, and key management systems. Some platforms specialize in specific blockchain protocols, such as Ethereum or Hyperledger Fabric, while others provide support for multiple protocols. Features may include automated security testing, real-time monitoring, and incident response capabilities.

For instance, a platform might offer tools for identifying and mitigating reentrancy vulnerabilities in smart contracts or provide real-time alerts for suspicious activity on the network. These platforms often integrate with existing security infrastructure, enabling seamless monitoring and management of blockchain security. Examples include platforms that offer security auditing services for smart contracts, providing detailed reports on potential vulnerabilities and recommendations for remediation.

Another example could be a platform that provides a comprehensive security suite for enterprise blockchain deployments, including features like access control, data encryption, and intrusion detection.

Outcome Summary

In conclusion, securing blockchain systems requires a multifaceted approach encompassing robust cryptographic principles, vigilant monitoring for emerging threats, and adherence to best practices in key management and smart contract development. The ongoing evolution of both attack vectors and defensive technologies necessitates continuous learning and adaptation within the blockchain security field. By understanding the vulnerabilities and implementing appropriate safeguards, we can harness the transformative potential of blockchain while mitigating its inherent risks.

Question Bank

What are the most common types of wallets used for storing cryptocurrencies, and how secure are they?

Common wallet types include software wallets (desktop, mobile), hardware wallets, and paper wallets. Hardware wallets generally offer the highest level of security due to their offline nature, while software wallets are more convenient but potentially vulnerable to malware. Paper wallets, while secure if handled properly, are prone to physical loss or damage.

How does Proof-of-Stake (PoS) improve blockchain security compared to Proof-of-Work (PoW)?

PoS reduces energy consumption and potentially increases security by requiring validators to stake their own cryptocurrency. This makes large-scale attacks more expensive and less likely compared to PoW, where miners can invest computational power without directly risking their own funds. However, PoS is not immune to attacks, such as those targeting the validator set.

What are some examples of blockchain security tools available for developers and enterprises?

Several tools assist in blockchain security, including static and dynamic analysis tools for smart contracts (e.g., Mythril, Slither), security auditing services offered by specialized firms, and intrusion detection systems designed to monitor blockchain networks for suspicious activity.